This content is password protected. To view it please enter your password below:

]]>

1. Is my institution able to develop and deliver the service to the targeted customers?

If the answer is “YES “ → consider doing it yourself

If the answer is “NO / MAYBE” → consider Question 2 below

2. Is (are) there a player(s) in the market that is (are) offering / can offer the service better than you?

If “YES / MAYBE” → contact the player(s) and verify your answer to Question 2

If “NO” → consider Question 3 below

3. Can my institution learn on its own (via external help) or is there someone in the market in a better position to learn with me (via external help)?

If “YES, I can learn on my own” → consider doing it yourself

If “NO / MAYBE” → consider contacting the other player for partnership

In addition, we would recommend that it is worth identifying what type of partnership could be established, create a screening of the market and financial institution to identify the feasibility and potential. Please see a list of options below.

- Type of the partnership: partnership with service providers, supply-based chain, value chains with processors and manufacturers, etc.

- Market: population, potential partners and their industries, competitions, successful or non-successful showcases, specific legal issues and overall government regulation, etc.

- Financial institution: target segment, existing product offer, efficiency of the loan process, regional presence, implemented IT tools (for instance, loan origination system, CRM), etc.

In order to obtain more understanding about partnerships, possible schemes and approaches, we would like to share a few useful articles and reports:

A winning partnership: Financial institutions and strategic suppliers:

https://www.mckinsey.com/industries/financial-services/our-insights/a-winning-partnership-financial-institutions-and-strategic-suppliers#

Marketplace vs platform banking – why the marketplace approach must prevail to better serve SMEs:

https://www.comparethecloud.net/articles/marketplace-vs-platform-banking-why-the-marketplace-approach-must-prevail-to-better-serve-smes/

Establishing a Successful Partnership Between a Financial Institution and a FinTech:

https://www.banklabs.com/2018/03/establishing-a-successful-partnership-between-a-financial-institution-and-a-fintech/

How Financial Institutions and Fintechs Are Partnering for Inclusion: Lessons from the Frontlines

https://content.centerforfinancialinclusion.org/wp-content/uploads/sites/2/2018/08/IIF-CFI_FI-Fintech_Partnerships_Final.pdf

Impact so far

Based on the number of registered entities[1], Serbia’s overall economic activity is made up of wholesale and retail (22.6%), processing (13.4%) other services (13.0%), and professional, scientific and technical activities (10.7%). The imposition of a general state of emergency and associated measures has brought a severe reduction in most of these activities (i.e. those not considered as essential such as food- and medical-related activities). In addition to the specific measures imposed by the government (e.g. restrictions on shops being open and the number of people allowed to be present in a shop at any one time), uncertainty around the situation has also caused consumers to cut discretionary spending, further exacerbating the situation for many businesses. Serbian entities most reliant on imported goods for production (i.e. those engaged in trade and production-based business) have been among the hardest hit due to restrictions on the import and transportation of raw materials both within and between countries. For example, the Serbian-based Fiat has ceased production of cars due to a lack of available imported materials from China. At the same time, businesses engaged in the service sector are expected to take the longest to recover as hotels, cafes and bars have been closed for nearly two months and, even after the lifting of restrictions, will likely operate in only a limited capacity for some time. In fact, the tourism sector has already been estimated to have lost EUR 300 million in revenue due to the cancellation of travel plans to Serbia. This impact on the service sector has also reverberated to their input suppliers (i.e. farmers and other food and beverage producers and suppliers). In general terms, the COVID-19 pandemic has forced many businesses to simply wait while the virus and the measures taken against it run their courses. Unfortunately, this is extremely difficult for MSMEs as significant disruptions can cause liquidity issues. Moreover, liquidity issues in larger chains often trickle down and cause liquidity issues in smaller ones.

Given the value of MSMEs to Serbia’s economy, it is crucial to understand what support they require in this difficult economic period. To this end, the National Alliance for Local Economic Development (NALED) and Business and Finance Consulting (BFC) (as part of the Development of Financial Systems in Rural Areas in Serbia Program (SRFP II), funded by the German Development Cooperation) conducted surveys, independently of one another, in an effort to better understand the impact of COVID-19 from the perspective of MSMEs themselves. These surveys revealed a number of interesting and important facts[2]:

- 65% of MSMEs are either temperately closed or are facing a decrease in sales.

- 63% of MSMEs expect revenues to fall significantly (more than 50%), with the remaining expecting moderate (up to 20%) revenue decreases.

- The biggest challenges MSMEs face include those related to the collection of receivables, maintaining adequate liquidity, demand decreases, having adequate capital to pay employees, organizing work activities in lockdown conditions, and being able to meet liability requirements.

- 80% of MSMEs are reluctant to lay off employees due to strong owner-employee relationships, instead of reducing hours, shifting work to home (where possible), or keeping pre-crisis levels of employee engagement. Additionally, MSMEs that do temporarily lay off employees are still paying employees a minimum of 60% of their wages.

- In April financial institutions have decreased their credit activities with regard to MSMEs, opting to wait for a government loan guarantee scheme to start before resuming such activities at normal levels. Subsequently, in May the trend was turned over as financial institutions have unfrozen lending and started approving loans with a state guarantee.

- Nearly all MSMEs have elected to take a 90-day loan holiday to postpone their fixed outflows and preserve liquidity.

The current crisis has revealed the vulnerability of MSMEs to supply and demand shocks. Limitations on the mobilization of the labor force, the disruption of supply chains and the shortage of raw materials and finished products have all been a domino effect of the measures taken to combat the spread of COVID-19. Moreover, the sudden unanticipated drop in demand over a prolonged period implies that even businesses with normally-adequate cash reserves are likely to face issues of liquidity shortages. If MSMEs reach a stage where they can no longer afford to retain employees, it will create a ripple effect in the broader economy as the increase in unemployment will result in a sustained demand-side shock to the economy.

Safeguarding MSMEs

Understanding the unique nature of the situation as well as that economic support measures will be vital to reestablishing the economy to normalcy, the government of Serbia has introduced a number of initiatives to support entrepreneurs and businesses, including:

- Opening up financing support for MSMEs via grants, liquidity and working capital loans from the Serbia Development Fund and a state-supported guarantee scheme for liquidity and capital loans taken from commercial financial institutions

- Tax relief measures, including deferring payroll taxes and corporate taxes

- Direct financial assistance (a one-off payment of EUR 100) to all adult citizens, which will presumably ultimately help support MSMEs in the form of increased demand

The private sector has also been active in providing Serbian MSMEs with the tools and resources they need to survive this difficult period and thrive once the threat has passed. For example, the SRFP II program developed and delivered a series of 13 free-of-charge online training sessions tailored to the unique, situational needs of Serbian MSMEs. These proved to be very popular as the sessions were viewed more than 1300 times in April 2020 alone. Moreover, the program remains committed to furthering such advisory support in the coming months by offering additional training sessions on topics related to digitization, management (including crisis management), planning, and technology usage. Any interested party is welcome to sign up via email at [email protected]. Some measures have also been developed to support those who, in turn, support MSMEs. Financial institutions are encouraged to take advantage of the resources available in this COVID-19 Technical Assistance Response Package as well as attend a series of crisis response webinars tailored to financial institutions and their unique issues. Additionally, everyone can stay up-to-date on the most recent important events related to Serbia and its economy by subscribing to two informational bulletins, BFC’s Agricultural Bulletin and FinTech Bulletin.

COVID-19 Aftermath

The impact of the COVID-19 pandemic is being felt around the world, and Serbia and its MSMEs are not immune. While the short-term outlook is rather bleak for most MSMEs, it is important to note that most experts do not believe that there will be any protracted recession, especially if adequate and appropriate response measures are taken to ensure the well-being of world economies. In Serbia, this means ensuring that MSMEs are given the resources and opportunities to pull through this crisis period. In short, the outlook is good if we make it good.

[1] https://publikacije.stat.gov.rs/G2019/Xls/G201919001.xlsx

[2] These results are a combination of findings from both surveys. It is important to note that each survey targeted slightly different business segments; as such, these findings only reflect broad generalizations regarding the general economic situation Serbian MSMEs are facing.

]]>May 2020 • Subrina Shrestha, MSME and Agri Finance Consultant (BFC, Nepal)

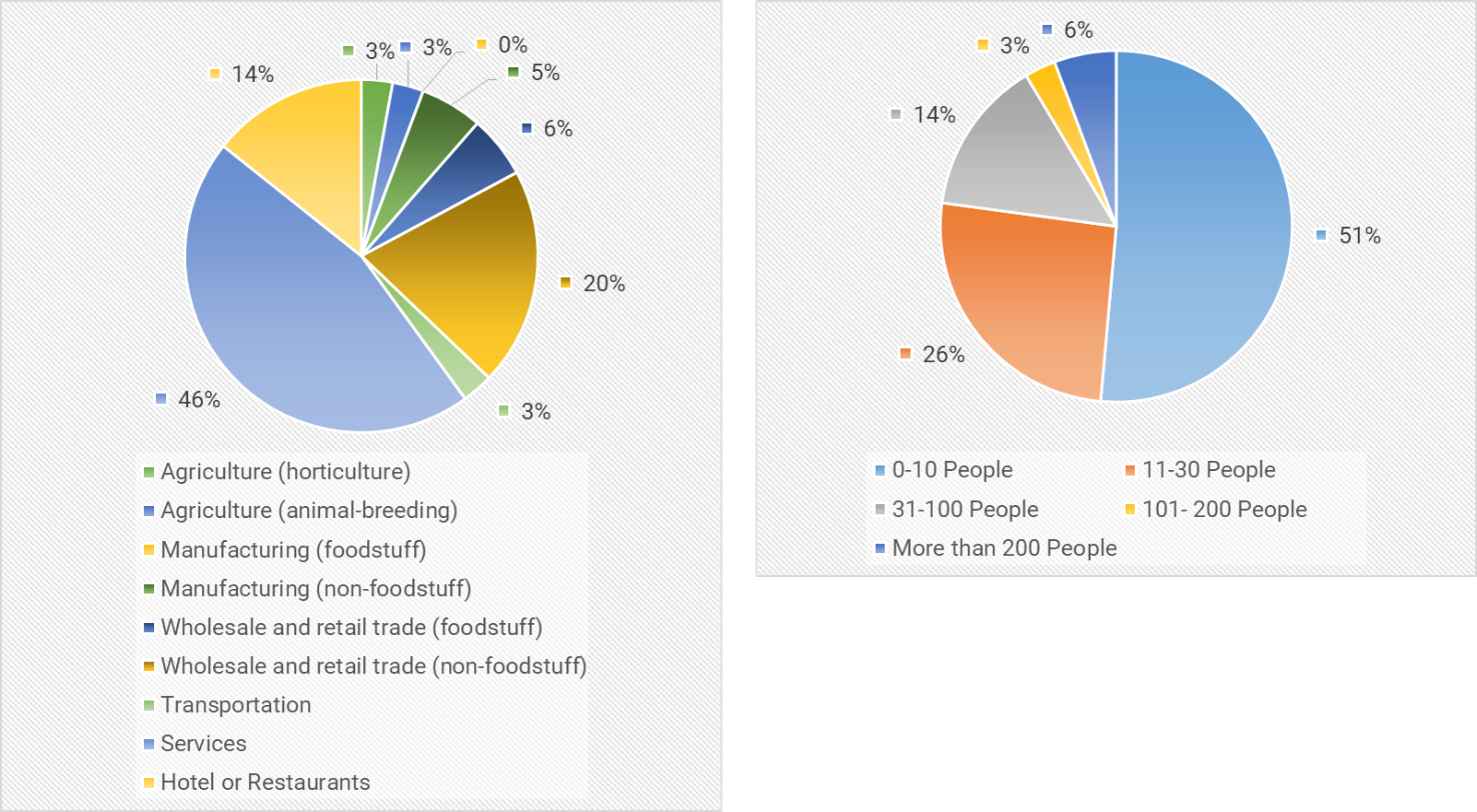

This article is the second part of the article published in April 2020 which was accompanied by a short survey. A total of 35 respondents were interviewed to obtain a general overview of the entrepreneurs’ perception and actions expected to be taken due to the COVID-19 crisis.

In Nepal, the elongated lockdown measure has resulted in a general environment of increased discomfort among businesses, and a restlessness among citizens evident by increased cases of people being held for defying the lockdown orders. The gradual (phased) lifting of the lockdown is bound to happen sooner than later. And when that happens, it won’t be back to business as usual. Revenue rebound for most businesses is expected to be slow, while cost continues to pile up and venturing into the unknown post COVID economy will compel businesses to take harsh steps.

Insights from the Survey

Recovery Mode On

The principal action for businesses will be to change gears from panic mode to recovery mode. It will be important to understand the damage done in terms of key numbers – cash flow, cost of cancelled contracts, etc. without being swayed by the negative bias around survival of businesses in a post Covid economy. The level of impact on businesses will be different depending on the sector and also on how the business model was or will be pivoted to adjust to the challenges of Covid. Stories of how perishable agri-goods are rotting in the fields are abundant amidst this crisis while on the other hand a few organized agri-based companies such as Mato, AgriMove, and Kheti are advertising their ability to supply fresh fruits and vegetables in Kathmandu. Flexibility and innovation in the way of doing business will allow smart entrepreneurs to prevail.

Staff Management and Pay Revisions

During the time of crisis, the decisions taken by businesses are bound to be scrutinized by the public. But the harsh reality is that businesses, in order to remain afloat, have to take strategic decisions that may result in layoffs and pay cuts. Adopting a lean management structure would be key to remaining effective during this time, and also providing an opportunity to consider innovative ways to manage staff would be beneficial.

Our survey showed that the top three actions that were forced to be taken due to the quarantine restriction, were 1) reducing employees’ wage/salary, 2) decreasing the scale of business and 3) reducing numbers of staff. It is imperative that if businesses decide to scale down, a number of current positions will be unnecessary or unaffordable resulting in further staff cuts. The current widely adopted option of reducing salaries also has to be strategic, as a flat percentage salary cut could be a risky proposition when compared to an earning bracket wise percentage cut (bottom-up approach) which ensures a basic survival income for lower earning staff members. While pay cuts may be unavoidable, businesses also need to strategize on how to retain and motivate staff. Options such as short-term sabbatical leave, and deferred payments (accumulated hours to be claimed during regular working days) may also be explored. The downward pay revision also needs to be revised upward as and when the situation improves, failure to do so could result in the company losing important human resources.

Coping with demand slump

There was an overall agreement among respondents that both domestic and foreign demand will drop, with the expectation of delay in the delivery of product/services to continue. The recovery, post Covid, is expected to be slow (U-shaped recovery), compared to the recovery witnessed post-Earthquake of 2015. A prolonged slump in demand will push the survivability of businesses, and more so for those with low cash reserves. While pivoting the business model should be a key emphasis for businesses, some trends may turn out to be temporary and businesses should not be swayed by the short-term trends fuelled by the crisis. It is key to analyze which behavior is likely to be a sustained behavioral change among customers and employees.

“Since we are in the travel industry, the entire year of 2020 doesn’t look good for us. People may not be willing to travel immediately even if the COVID situation improves”

Stimulus package/relief programs

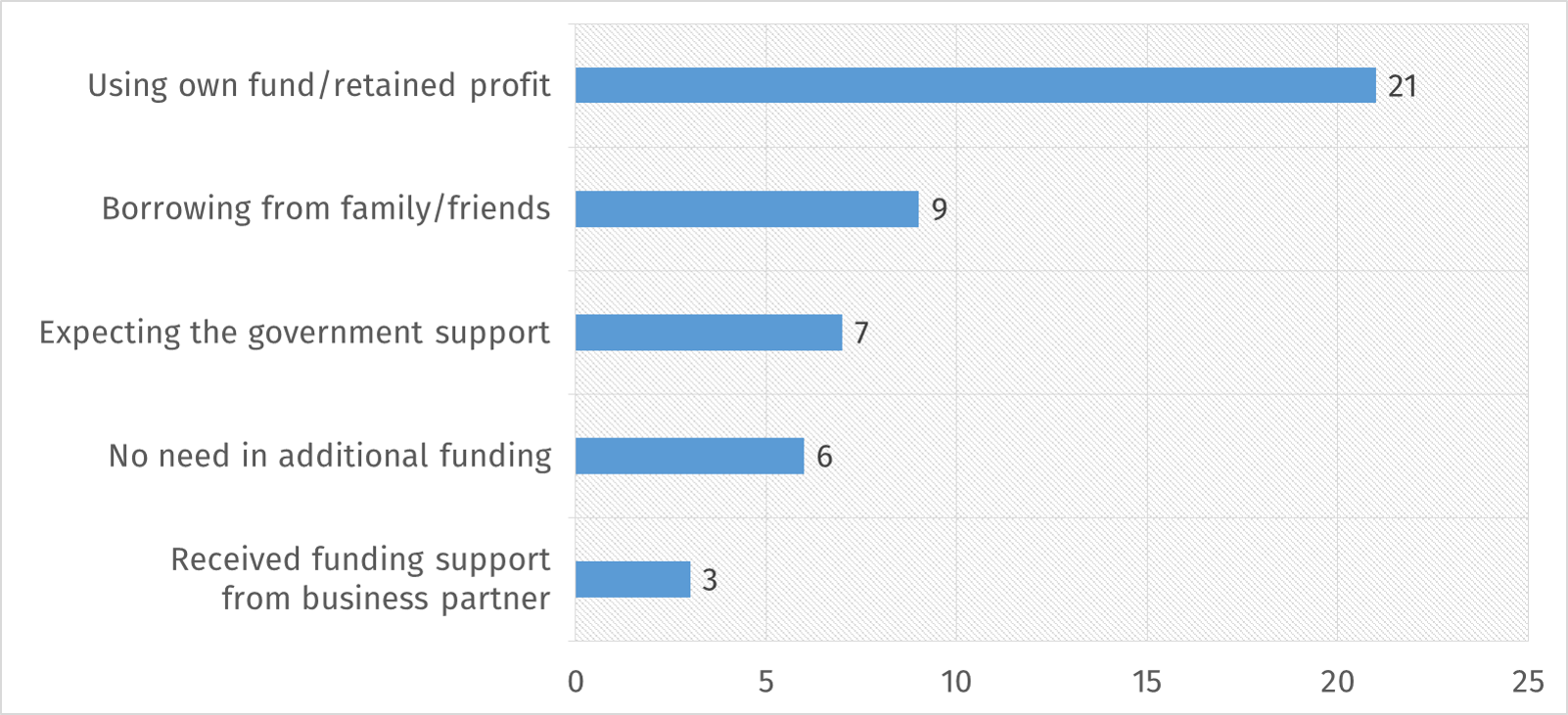

The government so far has only introduced relief packages for businesses in the form of interest rate discounts and tax payment date deferral. Our survey showed that, even in the time of crisis, the majority of the respondents (60%) preferred to use their own fund/retained profit to maintain their business, this preference was reported in combination with borrowing from family, friends and relatives (25.7%) and funding support from business partners (8.6%). Hesitation to take bank financing appears to be persistent in crisis situations. This, however, should not come as a surprise as the NRB survey on SMEs had shown that only 16% of SMEs finance their initial capital through bank loans. It is key to note that 20% of respondents are expecting support from the government to weather this crisis.

Top 5 funding conditions preferred by businesses during COVID crisis (multiple choice)

It is clear that the current support, in terms of interest rate, is likely to cover only a fraction of businesses and in some cases could be more of a missed chance for businesses with prudent financial management, high cash reserve cushion and low bank loan exposure. Looking at the programs introduced by other governments such as the US’s Small Business COVID-19 Emergency Loan, the Indian government’s scheme of tax breaks for small businesses and incentives for domestic manufacturing, etc. could be a good source of information on what the government can do and lessons on what the issues are, as well as, challenges in implementation. So the government could leverage on some second-mover advantage on this. There is no doubt that Nepal’s economy will need its own tailored relief package to address the concerns of the economy while not forgetting about the small enterprises ranging from agriculture to manufacturing.

“Our goods are stranded at the custom points since the last three months, leading to diminishing value of inventory and increased costs”

Capacity Building Support

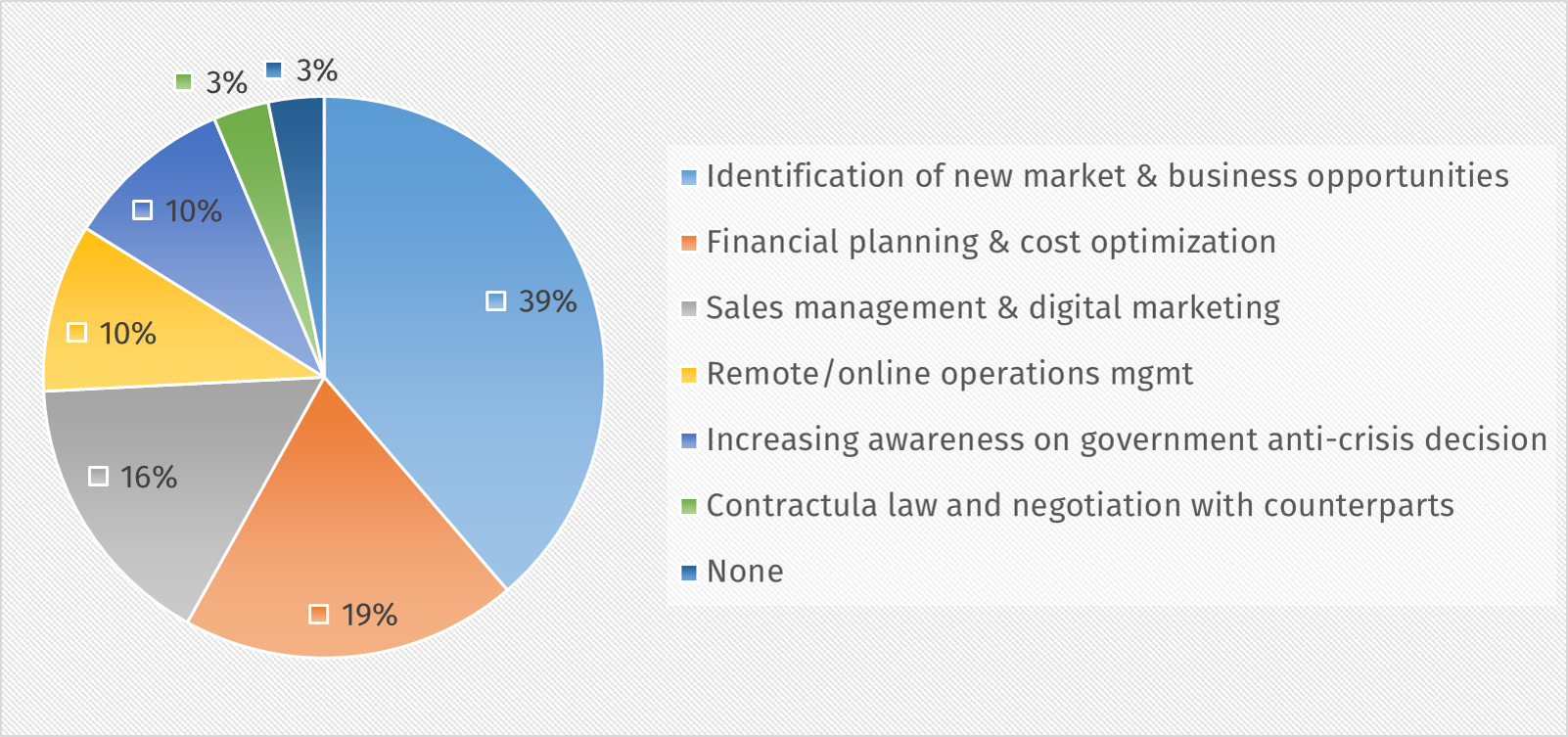

In order to sustain the crisis and ensure survival of the business, entrepreneurs also seek non-financial intervention in the form of capacity building activities. Our survey has shown that entrepreneurs are also looking for capacity building interventions with the top three identified areas being – Identification of new market & business opportunity, Financial Planning & Cost Optimization, and Sales Management & Digital Marketing. Donor funded projects could take this opportunity to devise training and activities around capacity building to enhance the capacity of entrepreneurs to weather the crisis.

Capacity building intervention sought by entrepreneurs

“Every industry still seems to be unknown about the daily consumption of their respective produce”

In a time of crisis it is easy to fail to see any positivity and lose sight of the bigger picture. It is not the time to make panic decisions but to concentrate on innovation and survival. There are no experts on this uncertainty and entrepreneurs all over are rapidly pivoting and innovating to sustain business. Entrepreneurs have to also actively advocate on the support that they require and voice their opinion as the government is also overwhelmed managing the crisis.

BFC in the implementation of KfW funded Sustainable Economic Development in Rural Areas in Nepal (SEDRA) has been providing capacity building trainings to MSMEs and agri-entrepreneurs. Covering areas such as Financial Literacy and Business Management, SEDRA upskilled the staff of its partner company Shreenagar Agro Farm and provided the required training toolkit, enabling them to continue with training activities even after the end of the project. Similarly, with the identification of lack of information as a key issue, SEDRA also supported its partner banks (Global IME Bank and NMB Bank) in Nepal to develop Good Agriculture Practices leaflets and capacity building toolkits for commercial farmers. In the current scenario, BFC has started a COVID-19 response package within which BFC’s team of banking experts provide free webinars on Crisis Response and answer queries from practicing bankers in its Ask BFC Q&A series.

]]>April 2020 • Subrina Shrestha, MSME and Agri Finance Consultant (BFC, Nepal)

Are there any silver linings emerging? What can SMEs do next?

Scenario of SMEs during COVID-19 in Nepal

At the start of 2020 Nepal’s government was optimistic of attaining the targeted GDP growth of 8.5% in FY 2019/2020. The promotion of Visit Nepal 2020 was also gaining momentum with high hopes; however, with advent of recent events, business as usual took an unexpected spiral fall since late March when the government decided to enforce a nation-wide lockdown to contain the spread of COVID-19. Although Nepal registered its first case in January 2020, stringent measures from the government were enacted only from 24th March 2020 onwards. Since the imposition of the lockdown, Nepal’s economy is estimated to have lost more than NPR 100 billion (USD 820 million) during the period of mid-March- mid April 2020 with the World Bank has revised the growth forecasts to the range of 1.5–2.8% for FY 2019/2020. As of FYE 2074/75 (2018/19), a total of 275,433 small and medium enterprises (SMEs) were registered in Nepal. The Industrial Enterprise Act 2016 defines small enterprises as businesses as having fixed capital up to NPR 100 million and medium enterprises as businesses have fixed capital between NPR 100 million and NPR 250 million. The SME sector contributes an estimated 22% to the GDP while creating employment for 1.7 million people (SME Financing in Nepal, Nepal Rastra Bank, 2019).

Challenges of SMEs

Weak supply chain linkages

Weak supply chain has been a key challenge for the Nepali business landscape historically with producers unable to find markets while consumers anguished with periodic shortage of goods. With the national lockdown, the situation has only further worsened as producers are now facing the problem of selling their finished goods as well as availing manufacturing inputs/ raw materials given the travel and import restriction along with limited resource mobilization capabilities. Likewise, on the consumer end, limitation or unavailability of infrastructural and logistical access has escalated the supply chain problems. Despite being allowed by the government to operate, essential produce manufacturers are forced to operate in lower capacity. For instance, the dairy industry is reported to be operating at 50% capacity due to difficulties to procure milk from farmers as issues with getting vehicle permits (preference for four wheelers) to operate during lockdown has restricted smallholder farmers and collection centers to transport milk. Similarly, in the livestock sector, the feed manufacturers are operating at 33% capacity as they are unable to import the raw materials and market the finished merchandise, while livestock farmers are abandoning business such as poultry citing lack of access to feed and of a market for their birds and eggs due to closure of some markets and time-restrictions imposed on retail market operation while also coping with transport restrictions. Limited operation of retail markets, and outflow of labor has restricted access to feed from the local dealers and labor for farm work.

Seasonal nature of business

Various M/SME businesses are seasonal in nature. The onset of wedding season from April 2020 would in normal times create high seasonal demand for services ranging from flower decor, food, meat, catering service, apparels, photo/video service, grooming services, hotel room and banquets, event management, precious metal consumption (gold, silver), the sale of electronic goods, furniture and so forth. It can be implied that even when the situation starts to normalize (post lockdown) weddings are likely to be a smaller affair with only few guests, thus curtailing demand for seasonal services related to weddings for the current year. Likewise, the cancellation of spring mountaineering expeditions and complete halt in tourist flows since late March, absence of celebration events during Nepali New Year (April 13th), halt in domestic tourism travel and business travel has created a major slump for travel related businesses. MSMEs and SMEs traditionally rely on the surge in demand during peak season to weather businesses through the lean period. Even post lifting of lockdown, the tourism industry is at best expected to pick momentum in 4-6 months while normalization is expected after the 2nd quarter of FY 2020/2021.

Low capital and thin margins

An estimated 33% of SMEs in Nepal fund their initial capital from ancestral property, 26% use the savings of their proprietor while only 16% is financed through bank loans. The survival of businesses in the current scenario will depend on the financial position and runway available. Although typically businesses will likely weather a one-month halt in transaction by eroding on the business’ cash reserves or proprietors’ personal savings or utilizing existing lines of working capital credit from financial institutions. Although some businesses have the privilege of continuing activities via work from home, others have reportedly started sending employees on sick leaves/ unpaid leaves, partial payment of salary while some are mulling laying off employees if the situation continues. The prolongation of the lockdown and expected delay in restarting businesses will have stronger implications on SMEs’ survival. A large number of white-collar and blue-collar workers have left cities and travelled to their home districts to weather the uncertainties of the COVID-19 crisis. This implies that it will take at least several weeks until all of them will have returned to their work destination domestically for business to start operating normally. Access to capital will be tighter and government intervention and stimulus will be the only support structure that businesses will look to for survival and recovery.

Expected continuation of decline in demand

As businesses fail to generate transactions, the resultant slump in earnings will impact the demand for non-essential goods and services. In addition to this, the halt in economic activities in migrant destination countries has resulted in layoffs with some countries sending laborers back home. Nepal receives an estimated USD 8 billion in remittance annually, which is evidently headed to spiral downwards to create a serious slump in consumption demand. This will create a further precarious situation for the survival of many businesses. Remittance alone generates one third of Nepal’s GDP.

Lack of awareness of relief packages from Government

The survey carried out by Nepal Rastra Bank in 2019 on SME Financing had highlighted that the vast majority of SMEs are unaware of programs launched by the government and central bank. This has contributed to the low uptake of subsidized or concessional finance.. Given these circumstances, it becomes evident that even when the government launches stimulus and relief packages, the lack of awareness amongst SMEs will curtail their impact . As 85% of SMEs take loans from commercial banks, it becomes crucial that the latter take proactive steps to ensure clear communication with clients on how to reap benefits from government programs, or to explore options for loan restructuring, based on projected revival of particular businesses so as to keep businesses afloat during the crisis. The same has also been observed during the earthquake and other crises which stand validation for the need to have special focus on a tiered and aligned approach of awareness and execution.

Silver linings

Amidst the frustration and fear from the pandemic, a few silver linings for SME are emerging

Rise of platform business and its adoption

The sudden halt in movement has compelled consumers and sellers to pivot their purchases and sales behavior, generating a surge in traffic to platform based online business. Before the lockdown, only a few platform based businesses such as Daraz, Kirana, Sastodeal etc. provided online grocery purchase services. Since the lockdown was imposed, other platform businesses such as Foodmandu, Bhojdeal, etc started a new line of fresh grocery delivery. The traditional brick and mortar supermarket also started taking orders via phone, viber, whatsapp and some from their own website. Agricultural produce companies, dairy, fresh meat suppliers who traditionally sold in physical markets are now seen to be associated with platform businesses to sell their merchandise. Post-lockdown also many of these businesses are expected to continue using these new distribution channels, changing the way of doing business particularly for small enterprises. The rush to digitalization will open many opportunities for SMEs as a whole.

Return of migrant labor (domestic and international)

A number of migrant workers both domestically and internationally have reportedly returned to their place of origin and continued to do so despite the lockdown in place. On a positive note, this has provided the much-needed youth labor in agriculture pockets where winter crop harvesting has started. Moreover, semi-skilled and skilled migrant workers are now a rich resource for the rural area where some have reported to have started investing in agriculture. NRB has also introduced a provision to avail subsidized loan for the purpose of starting a business, for individuals who have gained approval for foreign employment but were not able to travel due to the crisis. . This can potentially be leveraged to start new businesses and contribute to the revival of the local economy.

Awareness of importance of strong local infrastructure and economy

The disarray caused by the lockdown has increased awareness for the country’s need to become self-reliant on essential goods and invest in public infrastructure. The importance of a vibrant local economy from neighborhood grocery stores to well-equipped hospitals and labs in the locality has garnered major attention. While traditionally people in second tier cities, semi urban and rural areas relied on travel to the capital to avail services ranging from medical treatment to education, and to find jobs, the current lockdown has highlighted the importance of arm’s distance reach to basic infrastructure and facility. This hopefully is expected to translate into investment in local infrastructure, adoption and promotion of locally produced goods.

Next Steps for SMEs

Get your house in order

The forced break from routine work has provided an opportunity for SMEs to introspect on their business activities and strategies. Plans and activities that took a back seat to prioritize everyday business can now take the front seat – potentially providing a new pivot for the business, process reorientation, department audits, self-assessments, SOP developments and many other possibilities. As businesses already venture into pivoting work modality such as the adoption of remote working where previously it was an unthought of option, they could think of continuing to such measures during normal times, potentially resulting in adoption of cost saving measures. Additionally, businesses should utilize this time to develop crisis management plans, preparing for the worst from layoffs to downsizing and getting ready to take action as soon as the lockdown is lifted.

Funding sources

A number of start-up businesses globally are raising funds to tackle COVID-19 related expenses while new ventures such as telemedicine are receiving traction from early stage-venture capital funds. Nepal’s businesses have traditionally been reliant on bank finance; however, the expected tightening of liquidity could put a strain on availability and eligibility of this source of funding. The current scenario could provide a boost for domestic and international venture capital funds to establish stronger roots in Nepal. However, without the government’s will to facilitate FDI in SMEs, this potential channel of funding will remain out of reach for Nepal’s businesses. Nevertheless, SMEs should explore traditional and non-traditional means of financing (homegrown VCs, DFI funds, etc.) to weather the financial strain from the current crisis.

Fixed Costs Subsidies

As transactions have slowed down or come to a complete halt, businesses’ contribution margins are slimming down, cash cushions have also dwindled, thereby shrinking the funds available to cover fixed expenses. The Government as an immediate measure could defer tax payments for next quarter. Although the government could also come up with plans for subsidizing fixed cost ranging from rent, utilities, interest payment and other, in reality this will be an uphill challenge for the bureaucracy to administer, implement and monitor. On the other hand, SMEs should plan to push their cost obligations to the estimated time when revenue will start flowing. SMEs at the moment cannot afford to adopt a reactive approach but should rather proactively seek consultation and dialogue with stakeholders including competitors, customers, supply chain partners, etc. and lobby for support from the government. Without clear understanding of what kind of fiscal support could have a positive impact on SMEs, and in-depth understanding of the issues and their mid to long term repercussions, quick temporary measures that fail to address the underlying issues will only worsen the situation in near future.

]]>We are conducting a short survey to understand the position of businesses in context of COVID-19, if you are an entrepreneur in Nepal kindly fill the survey available here: COVID-19 Impact Survey - Nepal Based on the findings of this survey, we intend to continue with a follow up series with potential measures to be taken in Nepal to support SMEs.

European Microfinance Week. Luxembourg, November, 2016.

European Microfinance Week. Luxembourg, November, 2016.

Key challenges for agricultural value chain finance schemes

Ms. Mensink broke down the key challenges for agricultural value chain finance projects into project-related challenges and finance-related challenges. Project-related challenges come when trying to put the actual financing scheme together, such as: finding the right partners, organizing farmer groups, ensuring the use of quality inputs, and instilling the spirit of the program. These, coupled with financing challenges like identifying financing sources to meet the needs of a wide range of value chain actors, make establishing a successful value chain finance scheme a complex task. Despite the challenges, Ms. Mensink pointed to the example a successful scheme in Sri Lanka helping a local, family-owned business grow into a multinational company with diversified shareholders, and pointed to how companies can better interact with smallholders in agricultural value chain finance.

How other industries can become involved in agricultural value chains

Mr. Agwe presented on how value chain finance schemes have improved the fruit and vegetable market in the Seychelles, and how non-traditional industries in the agricultural sector, such as hotels, can become players in agricultural value chain finance schemes.

Warehouse receipt lending

Mr. De Bruyne discussed how warehouse receipt lending, the loan concept where the collateral is a securely-stored harvest of non-perishable agricultural products with foreseeable price fluctuations, is providing benefits for both smallholder producers — in the form of access to credit, better-informed sales decisions, multiple income moments and greater food security — and lenders, in the form of easy to commercialize collateral, good repayment rates, and rural penetration. He posed questions on how warehouse receipt lending can be made more efficient and secure for all stakeholders in the process.

Agroinsurance and bundling

Ms. Richter examined how bundling financial and non-financial services with agroinsurance can affect agricultural value chains and build the scale of agroinsurance. She gave examples of how farmers involved in a value chain in Zambia benefited not only from agroinsurance policies, but also services that gave them alerts when crop prices fluctuated or adverse weather conditions were forecast. She notes that, although there are risks associated with bundling, bundling implemented properly can help all stakeholders in agricultural value chains and encourage growth in a country’s agricultural sector.

The session ended with Mr. Kortenbusch thanking panelists and attendees for the insightful discussion on important topics related to agricultural finance.

Mariel Mensink is a senior program officer with ICCO Terrafina Microfinance. Bart de Bruyne is an independent financial consultant. Dr. Jonathan Agwe is a senior technical specialist with the International Fund for Agricultural Development (IFAD). Patricia Richter is a social finance expert with the International Labour Organization.

The author, Michael Kortenbusch, a former farmer, is the Managing Director of Business & Finance Consulting (BFC), a Zurich-based consulting boutique specialized in the implementation of innovative financing solutions delivered through financial institutions in emerging markets in support of agriculture and micro, small and medium enterprises.

]]>